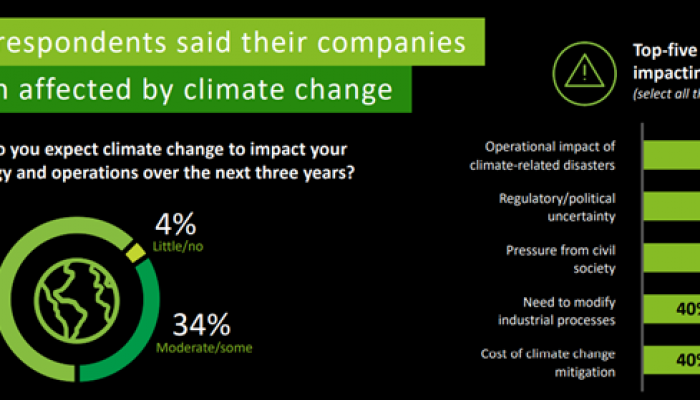

The 2022 PwC study 'Taking Action on Your ESG Strategy' notes that while six out of every 10 South African CEOs are “moderately, very, or extremely concerned about physical and transition risks associated with climate change”, their companies were still behind the curve when it came to taking action on climate change.

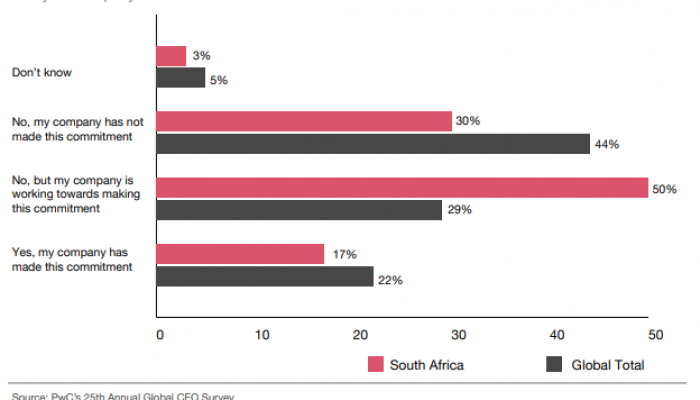

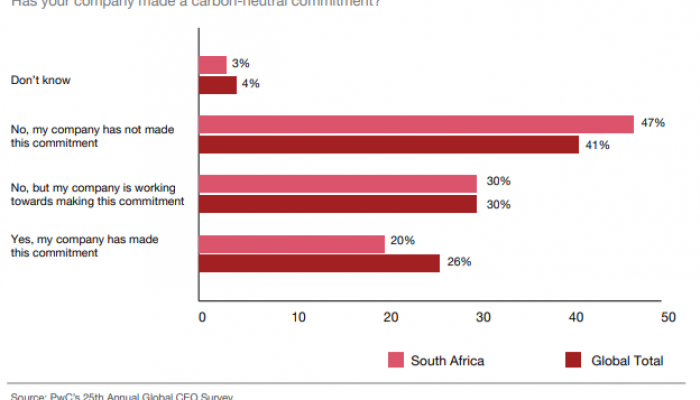

According to the report, “Seventy-seven percent of South African CEOs say their company has not made a carbon-neutral commitment. This is worse when compared to the global average of 71% ... Furthermore, 80% of local CEOs say their organisations have not yet made a net-zero commitment compared to 73% globally.”

PwC defines carbon neutrality as a state “when your organisation’s carbon dioxide (CO2) emissions are balanced globally by CO2 removal, typically over one year” and net-zero emissions as being achieved when an organisation’s greenhouse gas emissions “are balanced by greenhouse gas removals, typically over one year”.

Another sustainability study, this one from Deloitte, paints a slightly more positive picture. Commenting on the 'Deloitte 2022 CxO Sustainability Report', Deloitte Africa’s Anne Muraya told News24 that 79% of South African companies polled were already using sustainable materials versus a global average of 67%, and 75% of South African firms were improving energy efficiency efforts compared to a global score of 66%. In line with the awareness of South African business leaders to the potentially negative impacts of climate change, Muraya noted that 60% of South African respondents had already obtained insurance as cover against extreme weather risk, versus 46% globally.

A part to play

At a global level, the Deloitte report notes, “[C-suite executives] are struggling to take actions that balance short-term incremental steps with long-term measurable impact, nor do they seem to fully understand the benefits of embedding sustainability into business strategies and operations.” However, the research does show that leaders – including those in South Africa – are aware of and looking for ways to respond to climate change challenges.

Locally, this view accords with perceptions around environmental, social and governance (ESG) generated from good-news stories, such as Old Mutual Investment Group being named Best ESG Responsible Investor (Africa) 2022 by UK-based journal Capital Finance International or Exxaro taking the Best Sustainable Reporting Award (metals and mining category) at the UK-based 2021 ESG Reporting Awards.

For William Stubbings, associate director at Kantar Consulting, another company worth singling out is Vodacom. “They’ve made a strong commitment to renewable energy and they want to be 100% renewable by 2025, which is pretty incredible,” he says. “They have the financial muscle to do it, and the gumption as well. That is an example of a company that is trying and while you can always poke holes, it is an example to note.”

Vodacom Group CEO Shameel Joosub was among some 30 000 world leaders, officials, business people, observers, experts and commentators who descended on Sharm el-Sheikh, Egypt for the COP27 climate change conference in November 2022. The telecommunications group sponsored the event.

Talking to CNBC Africa at the time, Joosub said all corporates should be going down this path. “We as a company have to do the right thing and make sure we are playing our role,” he said. “I think shareholders will understand that we have to play our role in being able to help in climate change and to make a meaningful difference. That is our purpose…. When you invest in us, that’s the ethos you need to buy into.”

Joosub singled out the need for partnerships if businesses are to achieve goals such as reducing greenhouse gas emissions, which Vodacom hopes to cut by 50% by 2025 across its footprint. In 2021, Vodacom put its money where its mouth is by working with rivals Deutsche Telekom, Orange, Telefonica and Telias Company to create an eco rating for cellphones across various brands, helping customers to make more informed choices about sustainable brands and also how best to dispose of old handsets.

Looking north

There are similar, positive corporate stories coming out of greater Africa too, says Astrid Ricketts, Kantar’s Middle East & Africa sustainability director. She points to EABL East Africa Breweries Limited, the East Africa business of global drinks maker Diageo plc, and its support of the local economy.

“They’ve got net zero commitments through their grain-to-glass sustainability strategy pillar, but they are also very connected to local farmers, with the local economy, and they try to promote positive drinking, as well as inclusion and diversity. So, they’re touching quite a lot of parts of society,” says Ricketts. “They are so embedded in society; they own 90+% of the alcohol market. So, they have the power to influence governments and collaborate with government. I do think this is a company that is doing a lot of good – even though they’re an alcohol company and some people could argue that can never be good. But people are going to drink, right? So, we just need to make it safe, equitable and sustainable.”

In 2022, Diageo announced funding worth £450 000 for innovations focused on monitoring and reducing the impact of climate change and water crises on smallholder farms in Africa. With a focus on decreasing precipitation and its implications for food security and poverty alleviation, as well as supporting healthy soil and biodiversity, the East Africa pilot spans both environmental and social challenges facing local farmers.

This interlinked focus is important given that social challenges are deeply interconnected with environmental responses in Africa. This is why many African companies start their ESG journey with a social focus, says Stubbings. “You can kind of understand it – everything is connected and one issue creates another. I mean, green issues arise out of green inequality and a lack of education, there are a million examples,” he says, recommending that companies look back into their value chains when determining their response to ESG challenges.

“You can't just look myopically at your own competitive space,” he adds, noting that if alcohol manufacturing companies were truly committed to sustainability, they would look all the way back to the farms from where they source their products, and how laborers are treated. Rival beverage company SABMiller, for instance, recently released its first consolidated ESG strategy, which prioritises water preservation, renewable energy transition and ongoing support for and integration of small businesses into the supply chain, through the work of the SAB Foundation and the SAB KickStart Initiative.

What is important, Stubbings says, is that plans move from the page into action. “Your whole business’ sphere of influence must be coherent, you can’t just make a recyclable type of packaging and then start punting that to consumers claiming you’re a sustainable business if what’s happening behind the scenes in your supply chain is not working in that way,” he says. “It’s not something that you just start talking about as if it’s the new trend. It’s something that actually comes down to the nuts and bolts of the business.”

Where to start

Legacy, and the hangover of entrenched organisational culture paradigms, is another important aspect holding many organisations back from responding strongly to ESG matters. PwC’s research highlights how many companies still see ESG as a cost, not an investment, which relegates these interventions to issues of implementation, compliance and reporting, rather than as effective levers for transformation.

Stubbings agrees that not every company has the benefit of starting from a sustainable base, like Patagonia, the environmentally conscious, sustainable clothing brand. Instead, the best way to push forward is to carefully position ESG efforts around issues germane to the business. “You have got to understand the role of your category in sustainability and play against those issues. Not every issue is for you to take on, but you do have some that you must,” he says.

Where South African – and African – companies can learn from US-based Patagonia is the boldness to do things “differently to the way business has been done in the past”, says Stubbings.

In September 2022, Patagonia’s founder Yvon Chouinard and his family reinforced the brand’s sustainable capitalism credentials by “transferring their ownership of Patagonia, valued at about $3 billion, to a specially designed trust and a non-profit organisation”, reported The New York Times. The newspaper noted that the structure had been “created to preserve the company’s independence and ensure that all of its profits – some US$100 million a year – are used to combat climate change and protect undeveloped land around the globe”.

The new Patagonia trust structure is designed to separate voting rights from the harvesting of economic value, thereby ensuring that future decisions are not aligned to profit but to purpose. This model raises the ante on ESG strategy and opens the question of how companies are expected to grow perpetually in a world of finite resources.

“There’s a much bigger picture around how business is actually structured which, inevitably, has to change,” says Stubbings. “We can’t carry on like this much longer.”

ESG in Africa: A social backbone

When it comes to making a positive contribution to society, Dr. Jill Bogie, GIBS joint lead faculty for MPhil Corporate Strategy, points to three simple steps to guide ESG thinking.

- Think big – Think differently, think systemically, challenge assumptions and think in multiples.

- Start small – Begin with a purpose in mind which steers immediate actions. The purpose will help establish milestones along the way.

- Act now – Integrate sustainable development goals into your business strategy and business operations. It’s an ongoing process, so be guided by the purpose.

While ESG covers the gamut of environmental, social and governance issues, for African companies it is also essential to be in tune with the needs on the ground. This inevitably means that social upliftment features strongly. Finding ways to link a social focus to a critical climate change agenda is the challenge facing many companies across the African continent.

KEY TAKEAWAYS

- Six out of every 10 South African CEOs are worried about climate change risks, according to a 2022 PwC report.

- Yet, 77% of these companies have not made a carbon-neutral pledge, and 80% are yet to commit to net-zero.

- However, Deloitte research shows that 60% of South African companies have already taken out insurance as cover against extreme weather risk, compared with 46% globally.

- Big corporates and multinationals are increasingly becoming aware of the part they need to play in advancing the ESG agenda.

- In the African context, social inequalities often inform how a company responds to climate change challenges.