As the hype around lab-grown meat grows, the words of Dr. Frank N. Furter in cult classic The Rocky Horror Show could originate from almost any of the cultured-meat companies poised to take their meats to market. And as the expectation grows, many will be pleased to know that we may be enjoying cultured burgers as early as the end of 2020.

American food journalist, Chase Purdy, has explored the current race to end animal agriculture as we know it in his book Billion Dollar Burger. From California to the Netherlands and on to Israel, Purdy looks at the history of cultured meats, at which companies are succeeding, and probes the science behind the process and envisages future trends impacting the cultured meat industry.

Purdy also has another agenda. As good as this technology may sound, he wants consumers to have the facts. The firms playing in this emerging space are tech companies as much as they are food producers, and Purdy believes consumers need to be asking the right questions to keep this nascent industry fully transparent.

What is cultured meat?

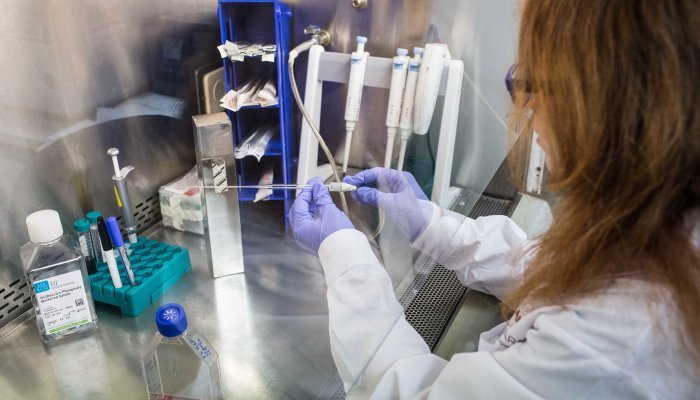

Cultured meat is essentially cellular agriculture. Meat cells are grown from cultures in a laboratory-style environment. As Purdy explains in his book, scientists need three key ingredients for this technology to work, namely the cells, a nutrient-dense liquid medium, and a sterile bioreactor in which to grow the strands of meat.

Purdy outlines the process in chapter three of Billion Dollar Burger, entitled The Molecular Miracle. In brief, a simple biopsy harvests the cells from a living animal. This is where any animal involvement ends. The process is not harmful to animals, which is a significant appeal of this technology. The cells are then transferred into a petri dish to get cleaned up and selected before being placed into a bioreactor, which contains the necessary nutritional medium to enable growth. In the early development of the technology, the substrate used to feed the cells was a fetal bovine serum, but not only is this an incredibly expensive option, it also defeats the purpose of reducing the environmental and ethical impact of meat production. Scientists are now experimenting with different plant-based alternatives.

Cultured meat is essentially cellular agriculture.

Cultured meat can take the form of aquatic, avian and mammalian species, with many companies choosing to focus on a specific area of specialisation. California-based Mission Barns, for example, is focusing on cultured bacon, while Israeli firm, Aleph Farms, is putting its efforts into cultured steaks rather than ground meat products such as burgers, mince and sausages. San Francisco’s Finless Foods, on the other hand, is invested in producing fish products like tuna. Yet more of these start-up companies have prioritised the likes of chicken. What is interesting, however, is that producers are experiencing greater success growing aquatic and avian meat products than their mammalian counterparts, meaning we are likely to see mass-produced chicken nuggets long before we see a 200g rump steak.

Why is cultured meat even a thing?

Driving this industry is increasing consumer awareness of the ethical and environmental impact of their dietary choices. Not only are animal agricultural practices unpalatably unethical for a growing number of people, but this form of animal husbandry also has a massive impact on the environment. From a greenhouse gas perspective, animal agriculture is responsible for 14% of total greenhouse gas emissions, according to the United Nations Intergovernmental Panel on Climate Change. Maastricht University in the Netherlands projects that this figure could even be as high as 18%. In addition, modern-day livestock farming is linked to deforestation, erosion, groundwater and water pollution, as well as extensive biodiversity loss.

Although consumer preferences have increased demand for plant-based meat products, Purdy says, “I do not think there is enough evidence that people are going to switch to a plant-based diet quickly enough to really make much of a dent in how climate change is impacting the world.” And although the plant-based meat industry is growing exponentially, the reality is that people do not want to stop eating meat. In the last 50 years, meat production has quadrupled. Globally about 350 million tonnes of meat products were produced in 2018, with more than 80 billion animals being slaughtered, according to research company Our World Data.

To address the ethical and environmental issues, as well as tap into this growing demand, over the past five years investors have opened their wallets to the tune of US$200 to US$300 million to support the development of lab-grown products, says Purdy.

Impact of cultured meats on the industry?

The production of cultured meat is in its infancy, but the impact it is going to have on the global food industry is potentially enormous. To put this into context, Purdy cites an Israeli biotech company that produces the equivalent of 1,200 chickens in a 600-litre bioreactor (the size of a double-door fridge). Companies like this are looking to scale up to 100,000-litre vats in the future. That means the production of 200,000 chickens per vat, or 10,000 chickens per 5,000 litres (imagine those green 5,000-litre Jo-Jo tanks) per month.

...people do not want to stop eating meat...

To date, there has not been much reaction to cultured meat from the meat industry, but it is just a matter of time. This technology is poised to disrupt the industry and, as such, has the potential to put thousands of farmers out of business. Purdy was cautious to make any guesses as to how the meat industry might respond, but in his book he talks about vegan food company, Eat Just, which faced ‘an all-out assault’ from US egg lobby groups and large corporates such as Unilever, which objected to their production of plant-based egg products like egg-replacements, dressings, vegan mayonnaise and even eggless scrambled eggs.

Marketers must create an allure around the product to build hype.

However, what is interesting about this technology is that big corporates have started to embrace consumer preferences and food giants such as Tyson Foods, Cargill and Conagra are all incorporating meat alternatives into their product ranges. Purdy says, “The most telling thing I have seen is when the former CEO of Tyson [Tom Hayes] was on Fox Business, and he referred to his company not as a meat company but as a protein company.” Food companies are increasingly investing in meat alternatives as they move to meet the consumption demands of consumers.

Fast-food chains are also keeping a keen eye on the development of cultured meats. The likes of McDonald’s and Burger King have already successfully included plant-based meat substitutes on their menus, so the introduction of cultured meat would not be a stretch. KFC’s Russian arm has started investing in a Russian cultured meat company to supply their chains with cultured chicken nuggets in the future.

Frankenburgers

The big question then becomes whether or not people will embrace this new ‘frankenmeat’. Purdy believes that, yes, they will. “Most people are genuinely curious about the product,” he says, adding that sheer curiosity will see people try it, especially if the end product has the taste and texture of meat and offers the nutritional benefits of high-quality protein. This combination is exactly what scientists are working towards. Purdy says scientists are not claiming that lab-grown meat will supersede the nutritional benefits of meat, but it certainly won’t be less.

And when asked about the taste of these products, Purdy stresses that not every company is equal. “Some companies are doing better than others, but among the most impressive I have tried was a chicken tender,” he wrote. Chicken tenders are strips of chicken, loosely attached to the underside of chicken breasts. “These products tasted very authentic, but more interesting to me was when you ripped it apart, it had the feel and texture that real chicken has.”

Purdy, however, believes the industry needs to be very careful about how it markets itself as it starts to launch itself into the markets. They cannot go to market offering a cheap meat solution as people will just not buy it, he says, adding that the marketers must create an allure around the product to build hype. For this reason, Purdy believes that cultured meat will initially launch in the market at slightly inflated prices. A burger, for instance, may land at the price of a premium cut of meat, or maybe double the price of a regular burger.

The industry has already seen that people are willing to pay a premium for interesting new foods. Products like the plant-based Impossible Burger is one of Burger King’s top sellers while the Beyond Meat burger, mince and sausages are doing exceptionally well around the world. In South Africa, a small punnet of mince costs around R200, but a consumer will be hard-pressed to tell the difference between premium beef mince and the Beyond Meat offering.

The next step in this journey will be the process of obtaining regulatory approvals. This requires companies to start creating pilot manufacturing plants so that they can give regulators the necessary data for the required sign-off. Countries such as Singapore are already eager to adopt this technology, explains Purdy, but it appears the rest of the world is looking to the United States and the European Union to make the first move. What could be a game-changer is the EU’s more conservative stance when it comes to genetically modified organism technology, which some companies are using in their cultured meat production.

While this may be a twist in the tale, whether it will derail this burgeoning movement remains to be seen.

Seven facts about cultured meat

1. Cells from a single cow could produce 175 million quarter pounders (125g burgers). Traditional farming would require 440,000 cows.

2. Global meat demand is set to increase by 73% by 2050, and currently, 70% of farmland is used for livestock farming.

3. Livestock farming is responsible for anything from 14% to 18% of greenhouse gas emissions.

4. Cultured-beef farms get their cells from animals that are not intensively farmed.

5. The price of a cultured beef burger is falling, and it is predicted that soon it will fall in line with the cost of regular burgers.

6. It takes 20,000 strands of cultured beef to create a normal-sized hamburger.

7. Although some cultured meat producers use genetically modified organism technology, many companies claim to be using 100% natural beef with no added chemicals.

Source: Maastricht University

Purdy’s pick of companies to watch

1. Mission Barns – California, USA

2. Aleph Farms – Israel

3. Memphis Meats – California, USA

4. Future Meat Technologies – Israel

5. Mosa Meat – Netherlands

6. Finless Foods – California, USA