Do dire levels of unemployment, inequality, and continued energy constraints mean the country is on the road to nowhere, or are there accessible opportunities that offer a glimmer of hope?

The economic landscape

“The relationship between business and the economy is inextricably intertwined. A country’s economic growth drives company performance,” GIBS faculty and investment specialist at Genera Capital, Adrian Saville, told the GIBS Economic Insight Conference 2022.

The relationship between business and the economy is inextricably intertwined: a country’s economic growth drives company performance.

As a small, open economy, South Africa’s economic performance remains closely linked to global commodity price fluctuations. While the last two years of buoyant prices have provided a tailwind, he explained that they hadn’t changed South Africa’s economic fundamentals.

South Africa’s per capita income is the same today as in 2010, suggesting the country has banked a lost decade.

“We don’t have a compelling investment proposition. We are big on telling a story but very weak on delivery. The difference between policy promises and delivery has gotten wider and wider. In the absence of getting to grips with the issues, we can expect more of the same, more stuttering and moving sideways,” Saville said.

Managing director and South Africa economist at Citi Research, Gina Schoeman, said protracted industrial action, state capture and increased political uncertainty had undermined the country’s reputation as an appealing investment destination. She explained that South Africa has a new GDP equilibrium of between one and two percent, as our inefficiencies have started to lead to lower growth. “Economic, political and social issues are below the surface, while global events continue to whip us around.”

Per capita growth and business confidence are important gauges of a country’s well-being, both of which are floundering. “Security of energy and electricity would create a huge difference in confidence and investment,” she added.

Power

With so much at stake, is it possible to industrialise South Africa to revive the once robust manufacturing sector, tourism, agriculture, and other large contributors to GDP? Can the government and regulators create a conducive environment, expediting the removal of barriers that inhibit business confidence and stall investment and growth?

Minister of Forestry, Fisheries and Environmental Affairs, Barbara Creecy, said that moving the economy toward sustainable energy sources represented a climate investment opportunity in the energy shift towards renewables and self-generation.

With most countries committing to net-zero emissions by 2050, South Africa is faced with transition risk, as 80% of our energy is generated from coal.

“We have to invest in low carbon technology to ensure our goods and services are produced in a low carbon environment. We require financial support and technological expertise to make sure workers are upskilled and reskilled for these new industries,” said Creecy.

“There are many complex problems we need to solve simultaneously,” Mandy Rambharos, general manager of Eskom’s Just Energy Transition, said. “We must invest in our competitive advantages and move the country forward.”

The utility’s mid to long-term goal is to invest in renewables and transition to clean energy while dealing with current generational problems. This would entail shutting down coal plants and replacing them with cleaner, cheaper, renewable technology.

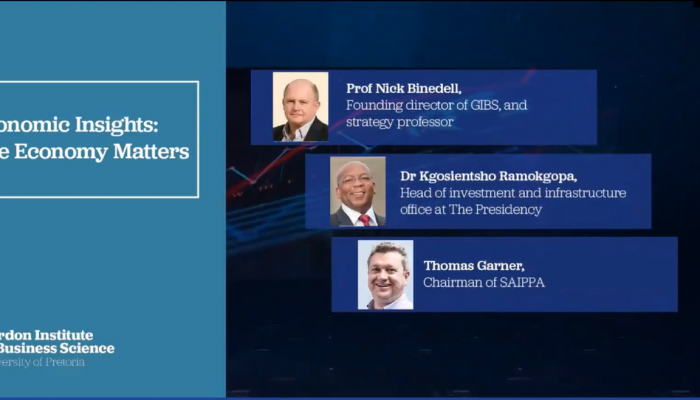

Thomas Garner, chairman of the South African Independent Power Producers Association, expressed frustration at South Africa’s slow advancement towards renewable energy and said many developers were ready to implement solutions immediately: “Minister Mantashe is the biggest obstacle in the transition of South Africa to renewables. It is all about vested interests. Government is divided, and policy is changed on an ad hoc basis,” Garner said.

Dean of the Natural and Agricultural Sciences faculty at the University of Pretoria, Professor Barend Erasmus, expressed the need for rapid and deep emission cuts. He said climate change would bring pre-existing vulnerabilities to the fore, such as water scarcity. “There is a closing window of opportunity. We cannot miss it; the consequences would be too dire.”

Production

Philippa Rodseth, executive director of Manufacturing Circle, explained that manufacturing could be an excellent growth driver due to its high job and value creation multipliers.

“Manufacturing allows for skills development and revenue from exports. South Africa can’t become a wasteland of imports. We must grow our pockets of excellence.”

However, she suggested that instead of implementing a localisation policy, South Africa should increase local demand through procurement policies to create a virtuous demand cycle.

Professor Justin Barnes, executive director of the Toyota Wessels Institute for Manufacturing Studies (TWIMS), said South Africa was less industrialised today than in the 1990s. Manufacturing, he said, accounts for less than 12% of the South African economy, as opposed to 22% in the 1990s. He added that the South African manufacturing sector had more employees in 1969 than it does today.

One mechanism for encouraging private sector investment is through the creation of Special Economic Zones, or SEZs. These zones, along with the fast-tracking of infrastructure projects, could incentivise the private sector to invest in the economy, argued Dr Kgosientsho Ramokgopa, head of investment and infrastructure in the office of the presidency.

Chief economist at the Development Bank of Southern Africa, Zeph Nhleko, added that economic growth and job creation were the main goals of SEZ creation. He suggested using state-owned enterprises as implementing agents to fast-track infrastructure spending.

Abundant opportunities exist for accelerating economic growth in the once-robust sectors of manufacturing, tourism, agriculture, and mining. However, these industries are currently stymied by power limitations, rigid regulatory frameworks and a lack of policy coherence and capability.

Sector review

- Agriculture

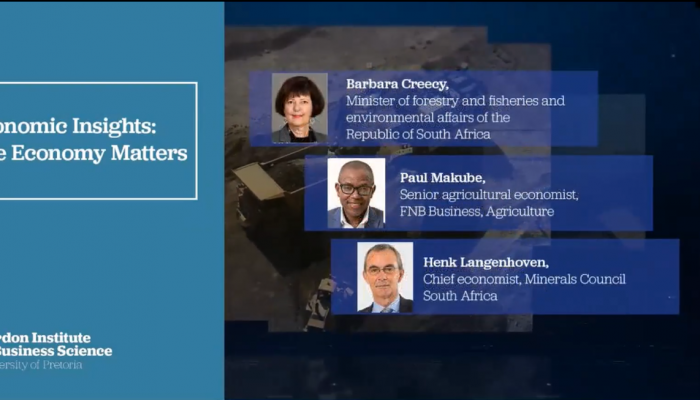

Paul Makube, senior agricultural economist, FNB Business, said infrastructure such as roads and rail were critical to the agriculture industry to ensure produce and commodities destined for export markets could reach the ports. “We have to be versatile and able to respond to shocks in external markets,” he said.

- Mining and minerals

Henk Langenhoven, chief economist of the Minerals Council South Africa, said the domestic cost pressures underlying mining, including energy, transport and fuel prices, continued to rise. “We are experiencing a commodity windfall at present, but we don’t have a pipeline in terms of productive capacity and are at risk of declining prices.”

- Tourism

CEO of the Tourism Business Council of South Africa, Tshifhiwa Tshivhengwa, said tourism thrives when government departments critical to tourism are functional. He singled out Home Affairs, the Department of Transport and the Department of Health. “We don’t seem to be able to solve problems fast enough to enable us to be globally competitive. We must do away with regulations that have been put in place that are stopping growth and act as a regulatory burden.”

***

Prof Nick Binedell, founding director of GIBS and strategy professor, argued the actual dynamism of the local economy lay in its different sectors. He explained how the Public-Private Growth Initiative, a national project which brings together leaders from business and government, has been expanded to include 23 sectors. Fueled and funded by the private sector, the domestic investment project aimed to propel South Africa onto a higher growth trajectory.

“The relationships and goodwill [between business and government] are there,” Binedell said. He encouraged business leaders to develop a profound understanding of their industry or ecosystem: “You have to develop an understanding of what the blockages are and what can be done to open these up in partnership with government.”

People

The relationship-building between the public and private sectors remains important to building the economy. Binedell argued: “We can’t afford a slow [policy] response. Business must put more money and talent into lobbying government. It is a major bureaucratic problem that government works in silos. I don’t think there is a sufficient level of urgency and slow rule-making leads to a loss of jobs.”

“There are major skills challenges in the public sector with limited capacity to grapple with the key challenges facing the economy,” Barnes said.

The private sector needs to be a change partner in the economy, as reform cannot be government-led. However, abundant opportunities exist if regulatory bottlenecks can be cleared and an appropriate sense of urgency is generated.

Barnes concluded: “The potential is there, provided that we deal with the critical issues. The future of the South African economy depends on solving the power issue with a robust energy plan for the country and dealing with the toxic political situation that is crippling our ability to take advantage of available opportunities.”

Political outlook

- We have exceptionally high levels of unemployment and unacceptable levels of crime and corruption at all levels of government. The bubble has burst, and South Africans are looking at alternative options.

- The ANC must get its house in order, or it must get voted out in 2024.

- Dr. Ismail Vadi, GIBS adjunct faculty, former MEC for Roads and Transport, Gauteng

- We are failing so dismally to realise all our potential and its advantages. We are in deep trouble as a country.

- Countries in trouble need citizens that step up and don’t retreat. We must realise that our problems are structural. Business needs its own vision of how to reform South Africa and how to grow our way out of poverty.

- Ann Bernstein, Executive Director, Centre for Development and Enterprise

Five important recommendations

- Reform must be private sector-led. Business must put more money and talent into lobbying government.

- Abundant opportunities exist if regulatory bottlenecks can be cleared and an appropriate sense of urgency is generated.

- Investment in low carbon technology in the form of clean energy and renewables will ensure goods and services are produced in a low carbon environment.

- Manufacturing can be an excellent growth driver due to its high job and value creation multipliers. Manufacturing allows for skills development and revenue from exports.

- Special Economic Zones and the fast-tracking of infrastructure projects could incentivise the private sector to invest in the economy.