Business must reclaim its voice

“Business has a responsibility to play a meaningful role as an important partner and stakeholder in society and I think it’s important to know where business comes from and what business thinks,” says Sipho Pityana, convenor of Save South Africa.

Flanked by former finance minister Trevor Manuel and Nedbank Group CEO Mike Brown, Pityana told a GIBS Ethics Forum that this was necessary so that other partners could engage with business and have an appreciation of the constraints under which business found itself.

“I don’t believe we can keep business out of politics, but I don’t believe it’s appropriate for business to set about to be a bunch of political activists. But business must fulfil its role and understand that the political space that’s there: it should influence, it should understand and it should contribute as a significant corporate citizen,” said Pityana, who is also Chair of AngloGold Ashanti.

He went on to warn against thinking of either business in general or, more specifically black business, as a homogenous unit.

“I have a discomfort in being associated with [the] Black Business Council which is led by somebody that I know has no ethics and no moral standing, according to her earlier conduct which was exposed elsewhere. I get sick in the stomach when somebody asserts to be leading black business with those kinds of credentials because it drags me in as part of that.”

Referring to what he called “the project of state capture”, Pityana said it had “very prominent business players. The GuptaLeaks had suggested so and nobody had contradicted this in any meaningful way.”

“Corruption is not just ethical misdemeanours,” stressed Trevor Manuel, “it’s a violation of law, and because it’s not possible for government leaders to actually deal with the issue partly because they replace competent people in administration with incompetents who already start out by owing a debt of gratitude to that leader, you collapse the system the way our criminal justice system has been collapsed in South Africa.”

Nedbank’s Mike Brown told the audience that “it is incredibly difficult to run a successful business inside an unsuccessful society.” For the business community, there had recently been “a rude awakening that politics drives policy, generally, that policy drives economic outcomes and economic outcomes drive the health of society over time. So it’s very definitely in business’s interest to be incredibly involved in policy and if you want to do that, you’ve got to be involved in the politics…”

Brown said that he had been enormously encouraged over the past couple of years by “exactly how strongly, business had found their voice, and in particular, an entity like Business Leadership South Africa… It is a very different organisation today from the one I joined 10 years ago. Business in general and South African society are better off for the fact that well-resourced organisations are making their voices very strongly heard.”

A Formula for Corruption

Combatting fraud, corruption, mismanagement and maladministration in any system starts “with accountability at the centre,” South Africa’s Auditor General, Kimi Makwetu, told a mid-year GIBS conference on Fraud and Corruption.

Explaining the role of accountability in preventing corruption, Makwetu flagged “the lack of consequences for things not going the way they should”. He cited research conducted in various cities around the world, which had attempted to pinpoint the main factors contributing to corruption in any institution. What it came down to, he said, was the following formula:

Corruption = monopoly + discretion – accountability

Makwetu explained that this means “if you’ve got a monopoly over stuff that you deal with as an institution and you’ve got large elements of discretion allowed to you, and if the level of accountability allowed to you is found to be low, you are bound to have high levels of corruption in that environment.”

He cited the example of a person who had just completed a teacher’s programme.

“The people who have the monopoly to appoint a person to a teaching post in a school is normally the district office of the Department of Education and nobody else. However, the people who are supposed to assess the applications in relation to the standards that are set by the Department for someone to come into the system have also got a level of discretion that they can apply. If that discretion is beyond the technical options that you have as an employer, then it almost extends to the situation of ‘pay me R5 000 if you want this teacher’s post’. That’s the kind of discretion I’m talking about.”

Speaking at the same event, Corruption Watch CEO David Lewis stated that he had no doubt that “the leadership of the police, particularly the Hawks and the NPA” were “the greatest obstacle to combatting corruption.” He noted that for this reason, Corruption Watch would develop a campaign around the appointment both the SAPS and the Hawks, both of which were due this year.

Disruptive technology boosts democracy

The technologies of the Fourth Industrial Revolution have enabled the democratisation of manufacturing processes, and brought advanced tools directly to entrepreneurs, wherever they may be in the world.

As a result, the days of waiting for the delayed arrival of technology to reach South Africa's shores are over: “We can be leaders in technology globally,” said founder of Alt Reality technology studio, Rick Treweek speaking at GIBS Forum on Disruptive Technologies, held in GIBS’ new learning space, Co.Central (see p.XX).

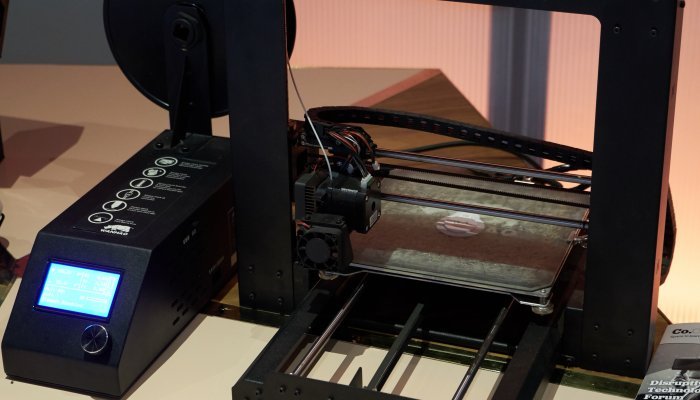

Stephen Gray, founder of The MakerSpace Foundation, said tools such as 3D printing and the proliferation of online instruction resources allowed for creativity and innovation, letting entrepreneurs use new emergent and disruptive technologies.

Gray drew parallels with the first Industrial Revolution, when people used new technology such as the Spinning Jenny to create cottage industries, and 3D printing, which he said could be considered the poster child for the Fourth Industrial Revolution. The technology has provided similar opportunities to innovators and craftspeople by providing them with compact versions of industrial tools, democratising industrial processes and lowering barriers to entry, Gray explained.

WeCustomize is a digital innovation company dedicated to 3D printing of customised products for businesses. Founder Nelson Sekgota explained that his company offers services to create a physical object from a digital file, layer by layer, also cultivating the creativity and participation of clients.

Guests at the Forum also had the opportunity to explore Co.Central and to examine a number of disruptive technologies on display.

NDZ – On the Stump at GIBS

Following in the footsteps of another presidential candidate, Cyril Ramaphosa, it was the turn of former AU chair and ex-Home Affairs, Health and Foreign Affairs Minister, Nkosazana Dlamini-Zuma to visit GIBS and deliver her campaign message.

“NDZ”, as she is nicknamed by her support staff, reminded those present that according to Stats SA, more than half of all South Africans still lived beneath the poverty datum line and inequalities remained high, with a GINI coefficient of 0.69 and “youth unemployment rates remained intolerably high”.

“If we keep increasing unemployed youth, who are becoming angry and frustrated, and keep increasing poverty levels that add to frustration, the levels of stability of our country and the ability of business to do business in a calm atmosphere will be compromised,” she said.

What she called “patriotic business” would want to change the status quo to end deepening poverty, inequality and unemployment, she told the audience.

Boosting GIBS' Top Team

Lecturer Morris Mthombeni has been appointed as Executive Director of Faculty, a role dedicated to supporting and managing full-time faculty while Professor Louise Whittaker takes over as Executive Director of Academic Programmes, responsible for the delivery of the business school's flagship MBA and other academic postgraduate programmes.

Mthombeni, who has been with the business school since 2014 lecturing in the leadership cluster, is a former chief executive of a large investment management business as well as executive director of a large insurance-based financial services company. He has more than 21 years of corporate experience, 15 of which are at executive level, and he is a non-executive director of a listed banking group. He completed a BJuris BProc LLB from UNISA and an MBA from University of Manchester (UK). He is currently studying for his doctorate degree.

Professor Whittaker, who also lectures at GIBS, is an expert on strategy, governance and ethics, particularly in relation to organisations and information systems. She has supervised over 100 MBA research reports and has managed a multi-disciplinary team of academics and administrators in the delivery of academic programmes. She is well published in many respected academic journals.

Fintech Innovation - Watching Carefully!

South Africa's Reserve Bank is reflecting very carefully "on how to respond to developments in the FinTech space," its Deputy Governor Francois Groepe told the audience at a recent Strate GIBS Fintech Innovation conference.

Groepe said that there were three proposals "which could serve to strengthen regulatory approaches to FinTech developments." These were:

Focussing on activities involving financial services rather than on firms or technologies

Continuing collaboration between local and global regulatory authorities and

Investing and deciding on the most appropriate structures, such as sandboxes, to keep abreast of FinTech developments and to allow for demonstration of the technology and experimentation with user cases.

Groepe added that he was "in favour of a 'back-to-basics' approach" under which regulators should "focus on regulatory principles that are risk-based rather than creating excessive rules-based regulations aimed at these technologies or products."

Referring specfically to virtual currencies like Bitcoin and Etherium, Groepe explained that "virtual currency is not without controversy....one of the challenges facing regulators, the private sector, government, as well as law enforcement agencies, is the lack of a common understanding of virtual currencies, including how they operate, the potential risks associated with them, and the vocabulary used to talk about them."