This could not be more different to the way I shop in 2022, usually via an app on my phone over coffee. I’ll check which retailer has stock of particular products, assess the specials on offer, then put in my order (enough to cover just a few days) and expect it to be delivered to my door within the hour.

Yet barely three years ago, this scenario would have been unimaginable to most South Africans. The retail landscape has shifted drastically, and the grocery market is more competitive than ever before.

Trends in context

Who’s got the best strategy, not just now, but to prepare for the changes that lie ahead?

I tried to ask retailers these questions. Shoprite declined to comment; Woolworths did not respond to several requests for interviews. After I tracked down a Pick n Pay PR contact, the company’s chief business transformation officer, David North, proved most helpful.

North notes that South African customers are worried about rising prices and their ability to make ends meet. “Offering value is vital for any retailer,” he says. “Give people value, and they will then engage with you on other things that matter to them – having a healthier diet, understanding the provenance of food, and shopping more conveniently, whether that is online, or in smaller stores closer to where they work or live.”

Natasha Smith, MD of Trade Intelligence, says it’s important to understand where retail trends come from. This requires understanding the global and then local context, particularly the PESTLE factors (political, economic, sociological, technological, legal and environmental).

She identifies several 'macro' global trends affecting the retail landscape: the advent of the digital era (including the metaverse); the rise of activism movements, such as Black Lives Matter; the new hybrid way of living, which she terms "blended everything”; the platform economy (which encompasses online communities, a more shared economy and multi-feature platforms that allow us to connect and interact in new ways); and the embrace of “total wellness”, which includes mental health as well as physical wellbeing.

There are also supply chain disruptions wrought by the pandemic, and the fact that more generations are economically active – even down to children shopping online. Finally, there's the increase in social commitment around climate change.

A shopper-led retail sector

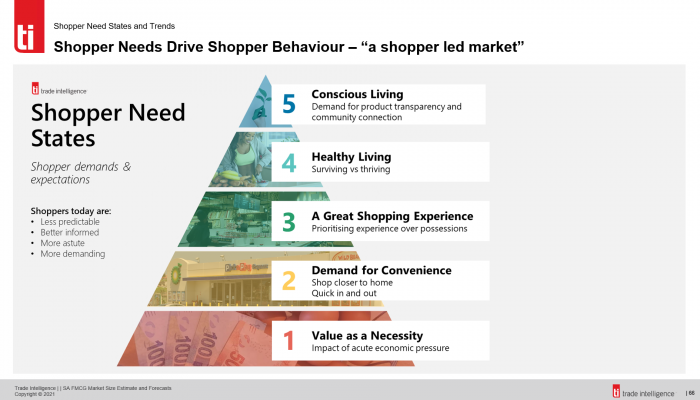

Andrea du Plessis, senior retail analyst at Trade Intelligence, says there’s been a shift in the retail industry over the past two decades from being manufacturer-led to brand-led and now to shopper-led. “Both manufacturers and retailers are responding to shopper needs,” she says. “We’ve developed a model that defines those shopper needs.”

These include value at the base, as a necessity, and then comes demand for convenience and a great shopping experience, as well as healthy living and conscious living.

Market response

Smith says that retailers respond strategically to trends from an internal and external perspective.

Internally, they look at what they can do within their business to improve. There’s a squeeze for margin and retailers can’t always afford to pass costs to the consumer. They need to sweat their assets and look for efficiencies. They will focus on the sales mix and look to innovate.

Externally, retailers are responding in three ways:

- Focusing on the shopper. Asking, “What strategies and decisions do we need to make that speak directly to the shopper?”

- Exploring formats and business models: This is about creating shopper-centric models and formats. “We call this hyper-segmentation in the channels,” says Smith.

- Conscious trading: This relates to commitment to environment and is important given shoppers’ increased awareness of what's going on in the environment. “Shoppers will choose or deselect retailers based on how they behave within the community,” says Smith. “They can't just be an entity to themselves anymore.”

She says there are also two broad types of 'enablers' retailers need to consider. “One is collaborations (for example what we saw with Pick n Pay and Bottles, which has since been acquired and become PnP ASAP).

The second one is around technology and data. Consumers today know that retailers are collecting data on them, and they expect them to use it to personalise the shopper experience. They actually get irritated when they feel the retailer doesn’t know them more personally.”

Several of these trends can be seen in Pick n Pay’s four-year strategic plan, Ekuseni, released in 2022, including hyper-segmentation of channels and embracing the digital world and hybrid living models.

North says Ekuseni is deliberately targeted to the key trends in the market. “We will double the size of our Boxer business, which is the best limited-range discounter in the market,” he says. “We are reorganising our Pick n Pay stores to give customers greater confidence and clarity in the market. Pick n Pay will focus on serving more affluent customers, with an emphasis on quality, range, innovation and freshness. And a totally new brand, Pick n Pay QualiSave, will give customers exceptional value in the growing middle market. We are also accelerating our offer to meet growing areas of demand – including our online agreement with Takealot and Mr D, and expanding our brilliant clothing offer.”

Strategy in action: What Pick n Pay is doing

North says that Pick n Pay is focused on delighting customers.

“Do that and customers will give you their loyalty rather than giving it to the competition,” he says. “Price and value are the most important things that customers are seeking in a very tough economic climate.

"As well as transforming our customer offer, we are working very hard to make our own business more productive and efficient – for example modernising our head office functions, reducing waste across our business, and equipping our people to focus more on winning for customers. We have set a target to save R3 billion over three years, and have made it clear that the savings will be invested straight back into giving customers lower prices and better value.”

He says the most important thing to understand about the local market is that it’s still growing.

“The informal market in South Africa accounts for around 35-40% of the total market. Customers trade across both markets, and the key to growth is to meet their needs for safe and nutritious food, offered in excellent stores, with unbeatable prices. This is a huge opportunity in the market, not just to grow, but to serve customers better.”

Who’s winning?

According to a Business Day article by investment analyst Chris Gilmour, Shoprite has the winning strategy. He highlights the group’s progress from upstart in the 1980s to the largest retailer in the Africa / Middle East region in 2022 (according to the 2022 Deloitte Global Powers of Retailing survey), becoming a R200 billion-turnover company and employing more than 140 000 people.

But while it’s the biggest competitor, Shoprite also emerged as the best performer across the board in Trade Intelligence’s 2022 annual comparative retail report, taking top place in several categories.

“Shoprite is the top performer in our analysis when it comes to delivering value to customers, shopper-driven innovation, convenience, new store concepts, and differentiation through hyper-segmentation,” says Smith. “In private brand propositions, Checkers is the winner (Checkers is part of the Shoprite group). They are also on top in terms of shopper-tainment (the whole shopping experience), and e-commerce and omni channel, with Checkers Sixty60. Conscious trading is the only category where we've actually got a couple of other retailers popping up, and that’s Spar and Woolworths.”

Du Plessis says that the results seem to indicate that “the closer a retailer’s strategy is wrapped around shopper needs, the higher their success in the industry provided they champion excellence in execution too.”

Strategy + execution

While good strategy is critical to success in the market, execution is just as important, Smith says. “I think success is a combination of that execution, external factors that we can't influence (such as pandemics and the like) and what your competitors are doing. You might have a great strategy and execution, but if your competitors are ahead of the curve, and just stronger, bigger, and faster than you, you’ll see results, there's a lag effect. And, comparatively speaking, you still may not land up on top.”

Du Plessis adds that Shoprite’s strengths from a strategic perspective are that it articulates its strategy very clearly, relooks it annually (unlike most competitors), and bases decisions on thorough market testing. Its Checkers Xtra Savings loyalty card programme is an example of this. The group was almost the last to market with a loyalty programme, but understood its consumers very well when it did (and their desire for instant gratification) and has already grown the programme to 24.7 million people.

Du Plessis says Pick n Pay deserves a mention for its new store segmentation strategy. “It’s quite controversial and I think it's an uncomfortable journey for them, but I also think it's the right thing for them to do.”

Responsive and progressive

Smith believes retailers need to strike a balance between being responsive and being progressive. “The responsive part relates to how shoppers know how much information you have about them. They want and need to be heard. They expect hyper-personalisation, customised solutions just for them. Retailers can't go on any longer without being responsive,” she says. “But I think there's a balance between that and being progressive. If retailers really want to win and they want to stand out, they need to move beyond product and solutions to purpose.”

Purpose is about conscious living: being community-minded, addressing social wrongs, standing for something.

This fits with a greater focus on environmental, social and governance (ESG) matters. As PwC South Africa notes in its podcast ESG in the retail industry, the social part of ESG is critical, not only in terms of retail organisations taking care of their own employees, but also their consumers (such as upholding the Consumer Protection Act).

“Retailers also need to be early adopters and pioneers of technology and data,” says Smith. “Use AI. Use this idea of the metaverse. Create experiences that consumers don’t even know they want yet. I think the retailers that really invest in that kind of progressive innovation and embed that in their strategies will go a long way in terms of winning the grocery wars.”